Artisan

Reason & Emotion

The past few weeks, I reflected a lot on why I do what I do and how, both from a dealflow/selection perspective and from a portfolio/support angle. It all started with a discussion that Tom Stafford and I had a few weeks ago.

This reflection was later fuelled by people asking how a generalist seed fund could thrive in a world where multi-stage funds are trying to eat our dealflow for breakfast and where specialists as solo or micro investors were trying to compete by being laser focused on specific verticals.

How could a generalist seed investor survive in this world? Before I answer, I will walk you through a couple of thoughts…

Emotion

I remember this scene from Equilibrium with Christian Bale. The plot is that the world has been cured of emotions. There is a disease in the heart of man. Its symptom is hate. Its symptom is anger. Its symptom is rage. Its symptom is war. The disease is human emotion. To cure the people of Libria from feeling, they take a shot of Prozium several times a day…

One day I was meeting with an investor, and at some point during our discussion, he told me with the most neutral tone: consumer companies bring me joy. Please send them my way. A smile of a nanosecond ensued like a rictus. It was terribly awkward. I couldn’t imagine how heartful founders, even more, if they’re building a social consumer product, could ever engage with a person like that.

A lot of investors are cold-hearted bastards playing humans. Good for them. Some of them are somewhere in between. And then, there are the real human beings who genuinely feel for the founders they work with, like Emmanuel Seuge from Cassius Family or Sarah Cannon from Coatue, to name two people I met the past week.

I hope I am part of the latter because this is my natural ethos. And I don’t care if it’s also a flaw that sometimes makes me unreasonable and not business-oriented enough.

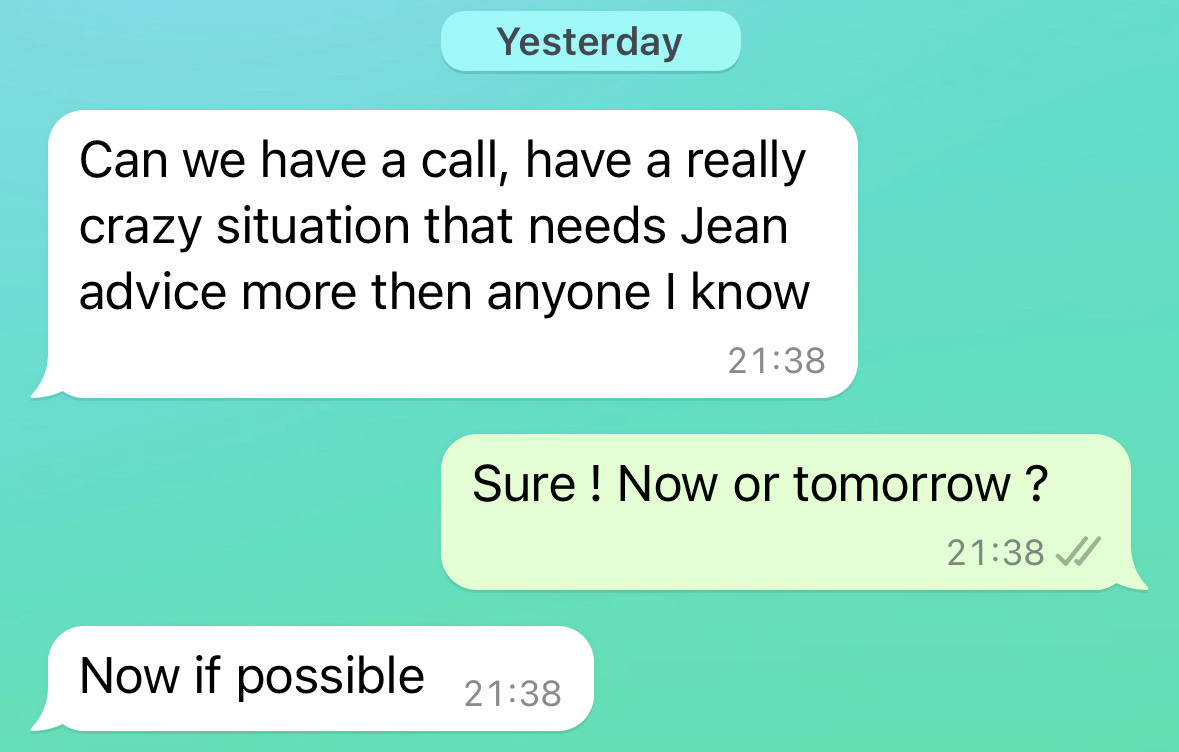

Yesterday I jumped on a call during the evening to chat with a founder who needed support. He called me because he knew I would put my interests aside and solely focus on the situation from his perspective. I don’t know if my advice was on point, but I am grateful that he needed to call me in this situation.

Reason

Few investors asked themselves what’s their role in the room. They go through their questions, scripts, and fears, where their mind drifts instead of intentionally figuring out how to make the most out of the interaction.

When you’re chatting with a founder looking to raise funds, your end game is to get the allocation you want. But before that, as an investor, you need clarity on your own decision-making process. Then you must gather the information that will allow you to go to the next step and finally demonstrate to the founder that you’re a sound partner who understands what they are talking about. Forget the questions that only clear your fears, forget the questions that make you look like you didn’t do your homework beforehand, and forget judgemental remarks or comments that undermine the hard work of those founders. A lot of investors are trying too hard, too much, asking too many questions, and focusing on too many details at first. The result is that, at best, it sounds heavy, but most of the time, it sounds like they are incapable of being enablers. They are mostly seen as blockers.

You know nothing, Jon Snow.

My job is primarily to understand, ask and articulate. Then only it’s sometimes to connect and resolve specific situations. Not to know.

My first mission is to understand what founders talk about, meaning their market, company, and moving pieces. If you don’t know the field, you’re dead already. Then I must form an opinion and own that conviction, even if it remains weakly held.

My second task is to ask questions, sometimes stupid, about the things that I really don’t understand or find odd because maybe they’re just misunderstandings, but they might be dangers hidden in plain sight as well. Sometimes I ask questions to help founders reflect on what they’re pursuing. I usually address the first principles and the basics. They are the root of everything.

Then I try to articulate the one or two things that matter and prevent them from graduating to the next phase of their company. It’s straightforward and stupid; it’s usually big elephants in the room… It looks like we don’t have a product-market fit. It looks like we’re not closing deals. It seems like we are not delivering features. It looks like we’re a junior team. It seems like the model doesn’t fly…

Bonus point if we can help you make the first hires, introduce you to the right investors for the next round, and connect you to strong people who match the stage, the geography, and the required field. And, of course, when issues arise, we’re usually in a position to help resolve those situations, like a fight between founders.

So, how could a generalist seed investor survive in this world?

First, don’t be a venture capitalist if you're not competitive. I love to compete, and I don’t settle until I win, so bring it on! Second, stupid battles aren’t worth fighting at seed, and we’ve seen many of them where founders and investors are playing a game of thrones. The seed stage isn’t a beauty contest. As a founder, you are looking for a match like an investor. I engage with founders through reason and emotion. If we match, we’ll find a way to work together, and the competition is over.