Nonsense: Equal Equity Split Among Founders, Infinitely

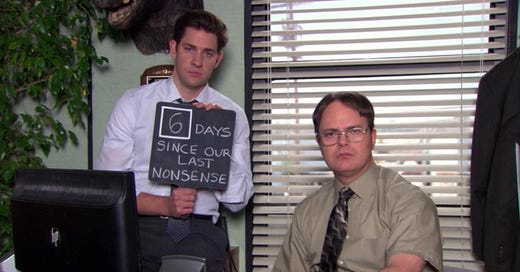

Usually, things come in series… But when it comes to disagreements between founders, it’s basically every few weeks or days, especially with a portfolio of 700+ companies like Kima Ventures.

Usually, an untold truth has been kept secret for far too long and suddenly the whole situation bursts into flame. Over the years, I have gained a sixth sense about those things and I have warned many entrepreneurs about their co-founders, whether they have demonstrated to be struggling, faking or simply failing. I have even pointed out situations years before they happen, and too many times unfortunately. It’s scary, but I have never been wrong so far. I have advised, thoroughly enough, all those founders to face the brutal truth with transparency and honesty as soon as possible to avoid a painful situation in the future. Unfortunately, most of the time, they haven’t listened and either had to cope later on with very difficult situations or have used their energy (at the expense of their closed-ones) to make their co-founders look good towards investors or buyers.

One way to force co-founders to think about and understand their role is to talk about the equity split and what it really implies on the long term.

Everybody talks about the initial split of shares. The best practice it to make it equal. It’s true that an equal equity split makes perfect sense initially, because it simply shows how you value your partners, which means at least as much as yourself. At the beginning.

It’s true at day zero that everyone is equally valuable, but not anymore after a while, let’s face it. An equal chance doesn’t mean an equal learning velocity, execution excellence and certainly not an equal output. Maybe in a generous world, but not in a fair one.

Think about it this way: As the organisation is growing or changing, some of the early employees will get diluted within the pool of new people while others will thrive, move up the ladder to take more responsibility. Those people will earn more money as well as more shares. That is perfectly normal, they’ve earned it. This meritocratic rule also applies to co-founders who must be aware of that. They are each one of them committed and accountable towards each others, forever.

Some people are learning faster and executing better.

For instance, the real truth about most companies is that the burden as well as the fame belong to the CEO. It’s both hard and rewarding for them. They have the responsibility to hold the whole crew together. And when they succeed, it’s just fair that they stand beyond their co-founders.

Some people might struggle to evolve with their company, and they should be brutally honest about it in order to preserve the company’s best interests. Of course it might be hard at some point to step aside and give away a chunk of shares or let a co-founder benefit alone from a stock option pool. But it’s also more honest.

Founding teams often avoid or forget to address the critical importance of being brutally honest and transparent with each others. They seem not to understand that their equity split isn’t bound to stay equal forever and should evolve overtime.

Sometimes we can’t, we suck, we fail.

That’s ok as long as we don’t lie to ourselves.

Ideas, presence, hard work have no lasting value.

Commitment, accountability and results have.

Men lie, Women lie, Data don’t lie.

Stay honest to yourself, listen to others.

Take full responsibility, not half of it.

Don’t make excuses, face the truth.

There is no autopilot mode for relationships and execution.