The Game

Exiting Zero-Sum VC Game

What got me into Venture Capital was counter-consensus. I was able to identify teams and companies that people didn’t believe in, and that eventually worked out pretty well.

My first milestone was Captain Train in 2012, which we later sold to Trainline. It was a modern train tickets platform, in a 70B GMV market in Europe alone, with poorly served customers and insane repeat rates. Obvious to me, not to the venture capitalists at the time who were questioning the margins. I admit they were thin, but not because of some competitive pressures like quick commerce or shitty operations like free-floating vehicles. The seed round closed (hardly) at 4.5M post-money, the Series A at 12M or so, and the Series B at 20M… The company raised about 10M in total before being acquired in Spring 2016 for 300M. Then came Zenly, a mobile consumer application to share your location with your close ones. At the time, again, the retention rates were through the roof, and the team had cracked a very elegant technical solution to avoid battery draining. No one had the courage to fund them when they raised their Series A. Consumer Social was kind of a desert island with no real success back then in Europe. And no one believed we could change that. It was my first big deal. That we sold to Snap 18 months later is anecdotical. The real win here is that Antoine Martin became one of the most iconic social consumer product builders over the years, inspiring and empowering dozens of entrepreneurs in the field. I could tell you about other counter-intuitive investments like Memo, Lago, or DICE that people underlooked because they were too busy playing the game…

The game in venture capital has become increasingly ironic (instead of iconic…). We are supposed to back more or less innovative companies that can scale, for which our money can accelerate their growth pace without breaking the overall equilibrium of their economics. With more and more money poured into the system, the number of opportunities increased tremendously, sometimes putting too many companies on the same map or simply too much pressure on each one of them, destroying the overall value of those markets.

You would imagine that Venture Capital would have become a more intentional industry, bridging certain gaps with the private equity world and becoming increasingly more professional. Well, it looks to me that it actually took the opposite route.

we make deals with no diligence. With the increasing competitive pressure in the venture capital world over the past few years, we’ve lost our minds. Valuations have skyrocketed to a ridiculous point across all boards. Founders demand investors to decide within a very limited period of time. Funds don’t do proper due diligence, whether it’s on founders or markets. I actually plead guilty and feel very grateful to work with Pia alongside me at New Wave, who reminds me of this every day.

Consensus spread faster than the flu, leaving founders at the mercy of hype, gossip, and groundless impressions. And it works the other way around with funds fighting on the same deals, completely forgetting that the best of them never arose from consensus. We are losing our outsider and outlier mindset here.

Kids are running companies with no adults in the room. Investors are supposed not only to invest but also to bring sense, experience, and network to first-time founders who are becoming prime entrepreneurs. It means helping them get surrounded by people who can help them learn and grow faster and better in their roles. Yet, it happens too little too late…

And bonus point… The VC world is fueled with entitled kids who have absolutely no clue about what struggle means in an industry that pays beyond reasonable, some of them who ask too few questions and give too many opinions. I am very often shocked by the lack of humility, patience, understanding, rational compassion, and overall genuine dedication from some of the people in our industry who are so incredibly lucky to do what we do. Oh yes, please blame me for saying that. And if you don’t have enough, we can talk about multi-stage bullshit, be my guest :)

The Game of venture capital has become more and more a Zero Sum Game.

Meaningful relationships, being the first believers, winning against consensus, and supporting entrepreneurs with intentions beyond money. It doesn’t take much to go back to the roots of what we do. This summer break is an opportunity for me to reflect on that and go after the real deals and the people I love working with.

Screw the game. Let’s play on our own field :)

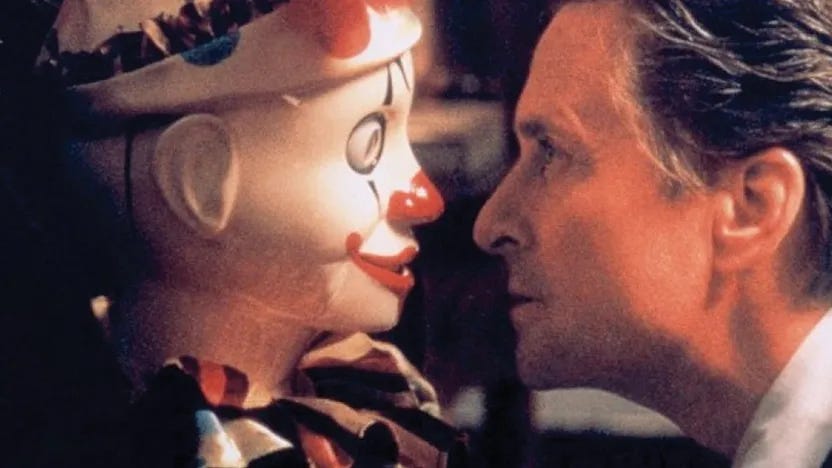

PS: By the way, do you remember that movie? The story of a wealthy investment banker in San Francisco who receives from his brother a voucher for a game powered by a company called Consumer Recreation Services (CRS)…

I totally get you. The last few years have been a wild ride with some crazy folks just chasing the party scene. Every time I had those wannabe entrepreneur crews in SF, I'd drop truth bombs: being an entrepreneur is 💩. But with the music blaring, my words got lost in the mix. And you know what really got me? These young guns aiming to be VCs. I mean, seriously? It was a total "wait, what?" moment. That's not their game; it's some old dudes' game. They should be out there starting stuff or diving into startups. The deal is, the last generation thought tech work was the cool thing, the trend. Back in the day, rocking out in a band was where it's at, not tech hustle. Time's flying, my friend, and damn, we're feeling the years. 🎸🚀