Disclaimer : english speaking readers can use the google translate photo app to go through the screenshots attached in this post…

Ralph Ruimy is an old pal whom I have known for about 10 years. He was the COO of Empruntis, sold to Covea, and then founded and sold two companies, an insurance comparison website (Misterassur) and an online marketing agency (Placedesleads).

We bumped into each other about two years ago and decided to catch up à la française over a long lunch, on the 20th of December, 2019.

Ralph was back from a severe health episode and wanted to go back in the ring, with more ambition than ever. He didn’t have a plan yet but he was sure that it would be in the insurance sector through an horizontal play, and that getting the agreement from the french regulator was a key differentiator to be more agile and in control.

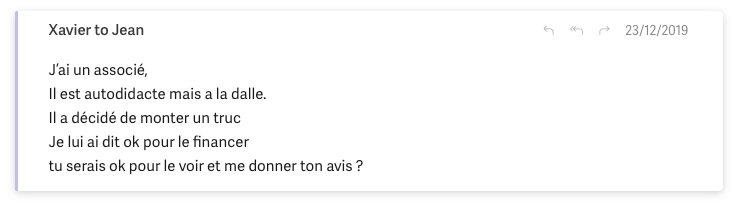

At the same time, Xavier reached out to me as Francky, a young entrepreneur he had been working with for a few years, was about to launch a new company…

We were to meet on the 6th of January to talk about his project…

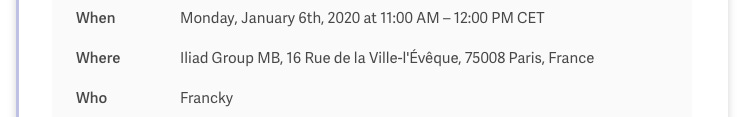

That same morning, before meeting with Francky, I had sent an email to Ralph following our lunch…

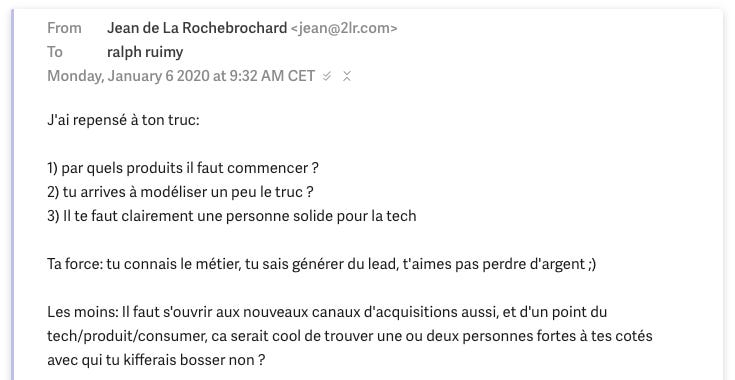

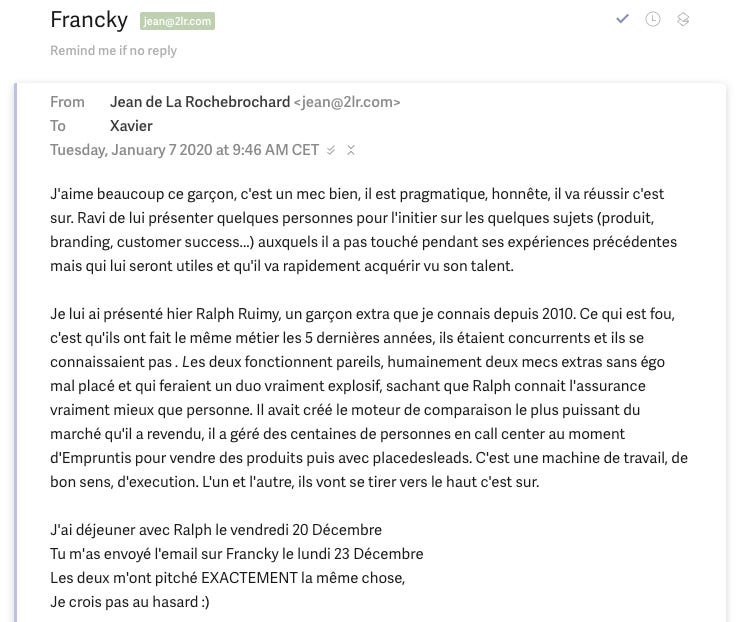

When I met with Francky in the morning, I realised that not only they had the same initial idea, but also that the two entrepreneurs were ultra-compatible, complementary, with the same set of values. During the meeting, I reached out to Ralph and proposed them to meet the same day…

After hearing from both Ralph and Francky about their get together, I sent a quick debrief to Xavier:

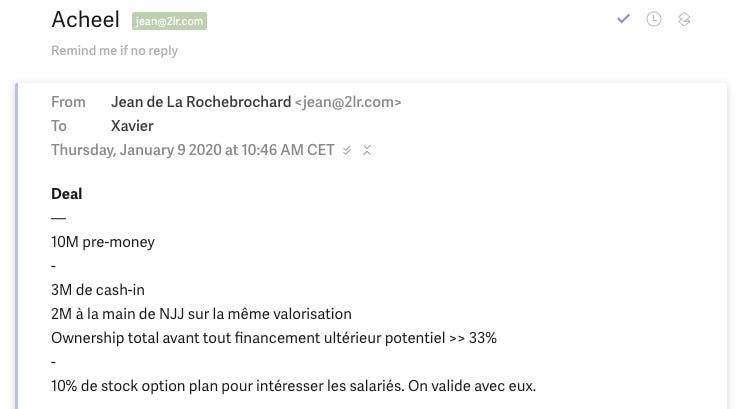

Just two days after, we were drafting the terms…

The 10% stock option plan wasn’t included in the pre-money, and the deal was that we would help them get their licence. The 3M + 2M deal was just a tranching, there was no conditions attached, Acheel could ask for the money whenever they wanted and we had a right to put those additional 2M whenever we wanted. Then the pandemic hit and the company started to structure its operations.

Early 2021, Serena and Portage Ventures wanted to jump in, but it appeared difficult to make a deal that would fit for both the entrepreneurs and the new investors. In order to limit the dilution for the founders and make the deal happen, we agreed with Xavier to convert our additional 2M at the new valuation (5x the previous one…) and therefore decrease substantially our ownership in the company despite our initial deal.

Other investors would call us crazy, in reality it was generous but fair looking at our initial deal. And whenever we have an opportunity to do the right thing towards a founding team, we try to act like very few others would ! We did this with Zenly, Payfit, Athenian, Ibanfirst, DICE… Just to name a few.

When I look back and think about how we make a difference as investors, it’s not about our limited experience, thought leadership on Linkedin or Twitter, nor our support army team to help entrepreneurs hire people and structure their company, it’s about building truly unique relationships with founders. We’re not here all the time, we’re here always !

Back on Acheel… They launched beginning of July, 2021. Every single month, I am shocked with their results ! They went from 0 to more than €10M ARR with a 86 NPS in just 6 months through a unique strategy that was even doubted by professionals and investors !

It’s incredibly rewarding to follow such journey since the very beginning, we can’t wait to see what they will pull off in 2022 ! :)

C'est super pour les personnes qui ont de la chance dans la levée de fonds qui ne dure pas éternellement! Et comme ça, ils peuvent se concentrer sur leur business! Mais, dans la plupart de temps, c'est long et fastidieux pour une somme bien moins importante! Je ne connaissais pas Acheel. Je vais voir... car je sais que l'on est plumé par tous les contrats d'assurance qui ne nous assurent finalement rien... :) Merci pour le partage!

Powerful story! Thanks for sharing!