Your Way

Better, Faster, Stronger.

Snap. Ephemeral pictures. Stupid?

Twitter. Short statements. Ridiculous?

Stripe. Payment platform. Seriously?

TikTok. Video sharing. Again?

It’s always easy to figure out through reverse-thinking a path of success. You take the most successful branches of the company’s tree of life and you go backwards. The closer from the origin, the smarter it sounds.

Snap, by warning their users when someone was screenshooting a picture that was supposed to be ephemeral, was building a truthful relationship with them, protecting their privacy, and in a way giving them back the intimacy they had lost on other social medias.

Twitter gave people the power to digest the world’s information the way they want.

Stripe built the easiest payment processing platform, empowering millions of merchants to convert their potential buyers faster and better.

TikTok has built the new brilliant social platform for creative expression.

Initial Assessment

Whenever we back a team, there are three critical factors, two initials, and a subsequent one:

Why them (people): whenever I assess a founding team, I am trying to detect the signals of their ability to remain clairvoyant optimist, to learn well from the best while taking a singular path, and to execute fast with excellence.

Why now (time to market): Uber couldn’t exist in 2007 for instance. Same with Zenly when they launched in 2015, the time was about right to provide reliability over location sharing.

Why always (built to last). It’s about the commitment of the founders to build a company on solid grounds, their emphasis on quality as much as speed of execution. As an investor, I always feel reassured when an entrepreneur manages to drive those two attributes of excellence and velocity with the same focus and energy.

The latter is too often under-estimated. It’s like the 24 Hours of Le Mans, the quality of your execution must last. Liabilities arise in companies, often, and the diligence with which they are handle can determine whether the company will live or die.

I like this tweet from Paul Graham, it reminds me how far an exceptional founding team can take over a challenge and build a meaningful, extraordinary company. It demonstrates how much founders are the elementary ingredient of the most superb success stories.

Once you’ve cleared the way about your conviction regarding a market, a team, and their ability to last, it’s necessary to keep the same clarity of vision about the path the company is taking. That will determine your ability to become a sound observer and supporter.

Strategic Assessment

Whenever I scan a company, I look at three elements:

The infrastructure (the underlying source of the market)

The product (as the medium used to address this market)

The distribution (the power of attraction)

For every company, you can define the underlying source of what they do, the heart of their product or service, and of course how they distribute it and attract people. More importantly, you can assess where the company stands at certain point in time and how it can possibly evolve and whether it makes sense or not.

There are two ways of doing things, either you build something fundamentally new that is bound to replace the existing, or you build around the existing to find your way through.

If you want to transform your industry, you must decide where you will build your edge, how it will fuel the rest, and whether you can build stronger assets on the long run through the whole value chain. Let’s take few examples:

Netflix built a subscription service as a product, creating its category. That was their edge. They leveraged dvd players to distribute Netflix on a nascent market (bottom-up distribution), while being integrated to a network of dvd resellers to access inventory (bottom-up infrastructure). Eventually they developed streaming as an infrastructure and content as a way to generate demand-driven distribution, but also allowing them to sell content as a product as well.

Revolut started as a full featured product, using existing banking infrastructure, while leveraging its community of users to distribute (thanks to the quality of its product). Eventually they are developing their own infrastructure and develop more and more unique features.

Dice built a supply-driven platform against the odds, building a better ticketing experience while using the existing infrastructure of the market. As they are growing, they have developed in-house tools to develop their own infrastructure, as well as additional product features to drive more demands as they leverage more traditional channels of distribution.

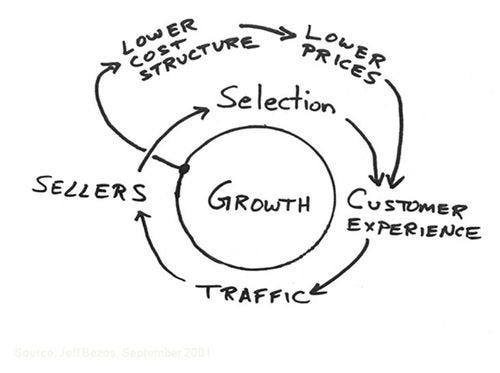

Debunking the myth of the flying wheel

I see what people are doing, looking at those tables, they are trying to link everything together, wondering if there is a path of causes and consequences to build. The answer is no, or not really… Flying wheels are harder and a lot more counter-intuitive than we think.

They are the results of many-to-many deductive interactions that must be mastered as a whole. Flying wheels are not recipes, they are used for people in the company to understand their dependencies and why their work matters, how instrumental they are in the organisation and how the chain could be broken if excellence doesn’t prevail everywhere in the company. Stop fantasising.

For Netflix, deals with the dvd players manufacturers, the logistic and the subscription models didn’t impact each others per se, nor were they causes and consequences. They were necessary elements that together would make the company work. And then it was about evolving towards building stronger ties between those pieces. Streaming allowed the company to better leverage discovery (and vice versa), exclusive content fuelled a more successful distribution…etc.

For Dice, to become an affiliate of another ticketing company wouldn’t have solved the scalping issues and everything that is wrong with this industry. They had to deal more and more exclusively with venues, they had to build a better ticketing system, they had to build discovery. It’s all those pieces together that drove more and more engagement with the venues, the promoters, the artists and the fans. And the more people were using the platform, the more they started to work on building better promoting tools and product features. Of course it ends up flying :) As an example, Dice will sign in January as many venue deals as they did in Q4 2019, which was as much as the full year of 2018.

The growth flywheel is when all the pieces come together, profitably, in harmony.

Define what’s your core, why, and how it might evolve. Don’t try to build bridges between all those elements, they will naturally come together as the company evolves.

Back on the matrix

Infrastructure, it matters a lot in Human Resources, Finance and Travel for instance. You can create your own infrastructure (top down approach), or build better integrations (bottom up). In any case, you have to decide where to start, why it matters, and whether you can or should build deeper integrations at some point.

A lot of Fintech companies have decided for instance to start by building better integrations to existing solutions before building their own infrastructure. Why ? Faster go to market, simply, in a race to gain market shares before their competitors, they understood that they had to build an amazing products to trigger a better and faster distribution flywheel. Revolut did this.

However, if you look at Ibanfirst or Alan for instance, unconstrained by the market dynamics, they have built their own infrastructure from day one, an edge that make them in full control of their product offering and business model.

Sometimes, you don’t have a choice, like Impala. If you look at the travel hospitality industry, which is fragmented with hundreds of thousands of hotels, using hundreds of property management systems and integrated softwares, your only way through the lower stack of this market, from an infrastructure standpoint, is to become an interoperable enabler, just like Plaid or Twilio did for their industry.

By the way, I just saw that Plaid got acquired by Visa for 5B+ >> WooooW

Product, are you creating a new category (like Netflix back in the days), are you getting into a new market enabled by new technologies (virtual reality), or as a consequence of a growing trend (big data)… In product category creation, market fit is at the core of your quest. As I like to put it, when you create a new product, the early adopters create illusions, the rise of users validate your vision, while buyers materialise your business model.

If you are jumping into an existing, crowded category, it’s probably better to act like Revolut, TikTok, or Weekendr, to build fast a full featured product that will allow you to create a distribution flywheel in order to win against the incumbents. From there only you start working on a more integrated infrastructure.

This distribution flywheel is how you create your own path towards acquiring customers.

DICE used venue acquisition to acquire fans, Revolut built a great full featured product. Sometimes you are able to build a mechanic or a viral loop that allow you to acquire customers for a fraction of their traditional cost. That’s why companies try to piggy back on existing platforms to build their own.

However, sometimes, you must use traditional channels. Netflix had to work with dvd players manufacturers, subscription based mobile consumer companies spread their ads everywhere they can at the lowest price, trying to find a good CAC <> LTV equilibrium.

This being said, at some point, you want to master both approach. Netflix is now using exclusive content to drive subscriptions. On the opposite side, DICE will be soon everywhere in town to drive more people on their app.

Conclusion

Think of your infrastructure, product and distribution strategy. Infrastructures are bound to be modernised, products are bound to be revolutionised and commoditised over and over, and distribution mastered.

Make it better, make it faster, make it stronger.

It never gets old :)